BitCoin: Technology & Morality

CS 463

Lecture, Dr. Lawlor

Technology of BitCoin

It's actually pretty simple:

- A "transaction" is moving some money between one address and

another.

- An "address" is an ECDSA public key. The corresponding

private key, which you keep secret, is used to authorize

transactions by digitally signing them. The public key

acts as the address's public name. There is no connection

between an address and a legal identity; one person could have

any number of addresses, and it's not possible to look at a

transaction and be able to tell the difference between somebody

rearranging their own accounts, and a major transaction between

two people. An address never has negative

balance--transactions that move out more money than are in the

address ("double spend") are not valid.

- A "wallet" is just a list of addresses and their corresponding

private keys. A wallet file contains 100 spare keys for

future use in the "key pool", so you can back up the wallet,

make some transactions, and still manage to recover.

- A "block" is a list of recent valid transactions, collected in

a peer-to-peer fashion. The "blockchain" is a hash-linked

list of all the blocks so far. If you receive money, you

have an incentive to make sure everybody knows about the

transaction, by getting it included in the blockchain.

- "Mining" is collecting and verifying the blockchain, which is

key to keeping the entire ecosystem running. About every

10 minutes, somebody finds a block + nonce that has a SHA-256

hash with "enough" leading zeros, where "enough" keeps getting

adjusted so they get found every 10 minutes. Currently you

need about 50 leading binary zeros, which takes thousands of

trillions of tries to find. The incentive to do this is

you're allowed to add a transaction moving 25 bitcoins into your

wallet at the end of the verified block!

The surprising things about it are:

- There is no central bank, and no central trusted

authority. Anyone can 'mine' to verify

transactions--they'll even pay you coins to do this. This means

counterfeiting is not really possible--you need to say where the

money in your wallet came from for the transaction to be

valid. In particular, officially sanctioned inflation like

the 1933 Gold Executive

Order, or today's quantitative easing, is theoretically

impossible. (Granted, the government could just ban

BitCoin and require people to use GovCoin, possibly at some

exchange rate.)

- By design, BitCoin's overall behavior is similar to the gold

standard. Whether this is a bug or a feature depends on

your point of view.

- The total value of the BitCoins issued, times the current

BitCoin/dollar rate, is about a billion dollars. This

makes it big enough to be interesting to investment banks like

Goldman Sachs. The total value of the US dollar is

something like $10T, so BitCoin is a fairly minor currency.

Morality of BitCoin

One problem with BitCoin is nobody knows what the value should

be--is a pizza 10,000 BTC or 0.0001 BTC? Value stability can

be a problem with any currency, where there are two macroeconomic

error conditions:

- Inflation: value of the currency drops. Slight inflation

is usually considered beneficial, since it acts like a tax on

currency doing nothing (not invested in productive

activity). Extreme inflation, "hyperinflation", first

destroys savings and then destroys commerce, and is basically

always caused by the supply side, where the government keeps

printing money, usually to inflate away government debt.

- Deflation: value of the currency rises. Deflation is

easy for the government to fight if they can just print more

money. If they can't, such as due to the gold standard,

there's a serious problem with debt--deflation makes it harder

for borrowers to repay with the more valuable currency. If

borrowers can't repay, lenders won't lend and the economy siezes

up.

The other huge problem with alternative payment services is they

tend to get used for thing you can't do on legitimate services--for

example, illegal transactions like money laundering or drug

transactions. This means what looks like a technical issue,

preserving anonymity in transactions, turns into a very

controversial social and very thorny moral issue.

For example, the $1m/month online illegal drug marketplace

Silk

Road uses BitCoin as its payment service, despite denominating

prices in US dollars. Dealers and buyers still get busted, but

it's during delivery, or because they didn't hide their IP address

sufficiently, not via the payment service.

Morality of Drug Laws

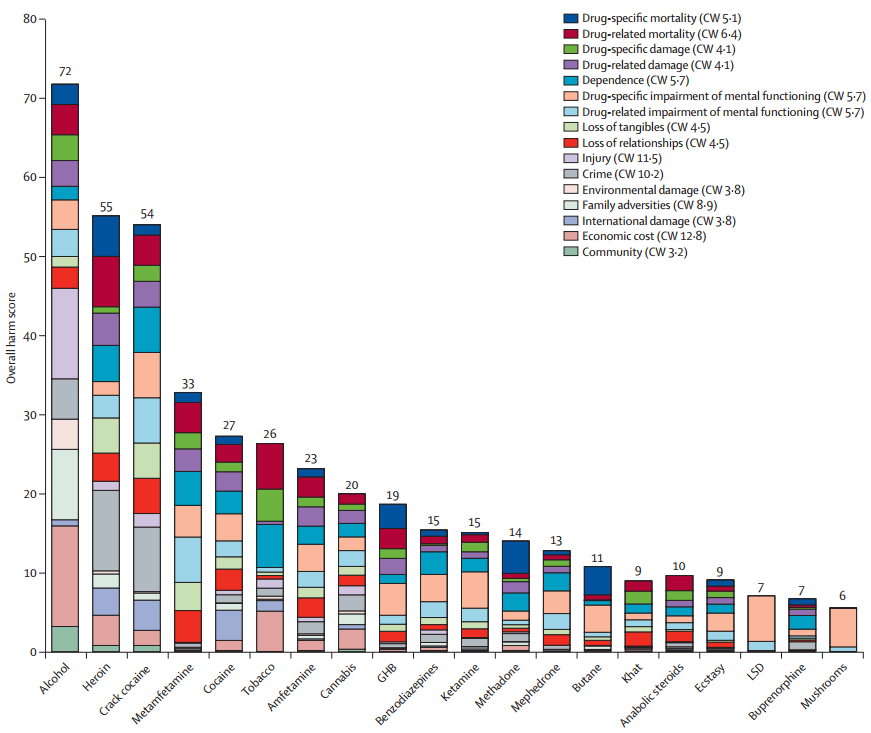

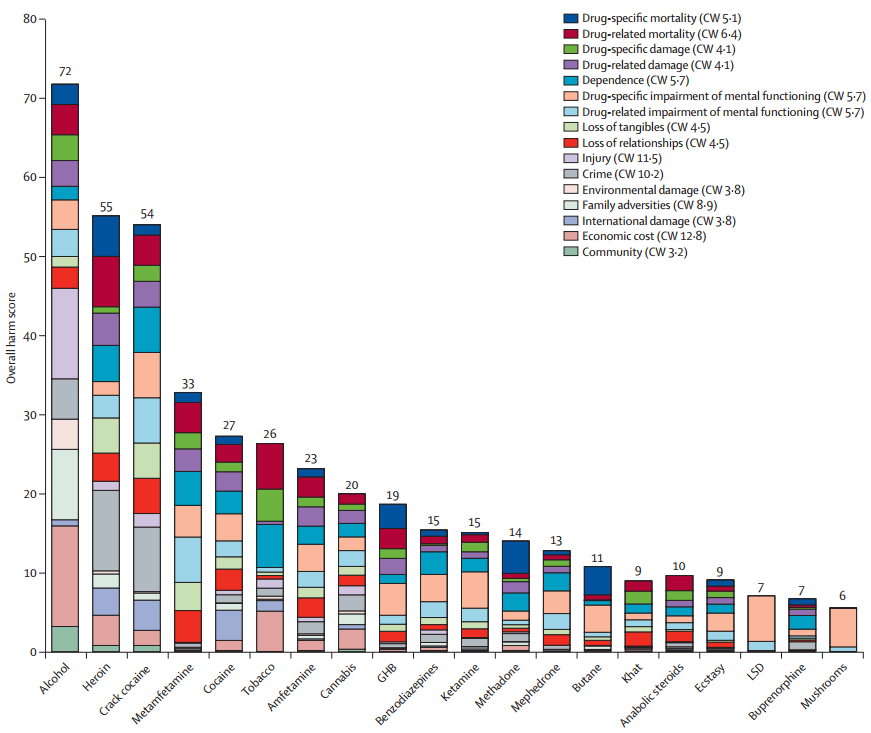

In 2010 a doctor of neuropsychopharmacology in the UK led a workshop

of experts to quantify

the harms from a set of drugs, resulting in this surprising

chart:

The first author of the study, David Nutt, was fired

from his position on a UK government research council due to

disagreements about this approach.

I personally am not sure what the lack of correlation between harm

and legality implies--should we ban the manufacture, possession, and

distribution of alcohol too? Legalize everything to the right

of some trade-off point? Reboot our approach to drug addiction

entirely? How? Unfortunately, there are no easy answers, only

complex and historically dependent trade-offs.

One lesson here is you can't ignore the second-order and third-order

effects of your choices. The designer of BitCoin chose to make

transactions anonymous, which has fairly straightforward

implications for a very touchy subject that could result in BitCoin

being demonized and banned.